In a significant de-escalation of trade tensions, the United States and China have agreed to drastically reduce tariffs on each other's goods for an initial 90-day period. The agreement, announced Monday following weekend negotiations in Geneva, Switzerland, marks a dramatic shift in the trade relationship between the world's two largest economies.

Under the deal, the US will temporarily lower its tariffs on Chinese imports from 145% to 30%, while China will cut its levies on American products from 125% to 10%. Both countries have agreed to implement these reductions by Wednesday, May 14, providing immediate relief to businesses and global markets reeling from the recent trade war escalation.

"We had very productive talks and I believe that the venue, here in Lake Geneva, added great equanimity to what was a very positive process," said US Treasury Secretary Scott Bessent at a Monday press conference. "The consensus from both delegations this weekend is neither side wants a decoupling."

The agreement represents a 115 percentage point reduction in "reciprocal" tariffs for both nations. However, the US will maintain its 20% duty on Chinese imports related to fentanyl concerns, which President Donald Trump imposed earlier this year. This previous tariff accounts for the difference between China's 10% final rate and America's 30% level.

Chinese Vice Premier He Lifeng led Beijing's delegation during the talks, describing the agreement as an "important first step" that establishes a foundation for reducing tensions. The Chinese Ministry of Commerce reiterated this sentiment, urging the US to "completely rectify the mistake of unilateral tariffs" and work toward greater economic stability.

As part of the deal, China also agreed to suspend or remove its non-tariff countermeasures against the United States, including export restrictions on rare earth minerals and the blacklisting of dozens of American companies since April 2. These measures had threatened to disrupt critical supply chains for electronics, military equipment, and pharmaceuticals.

"It's a more civilized way to divorce. The bifurcation will continue, This meeting is basically an attempt, hopefully successful, of avoiding a global recession." - Alicia Garcia-Herrero, chief economist for Asia Pacific at investment bank Natixis.

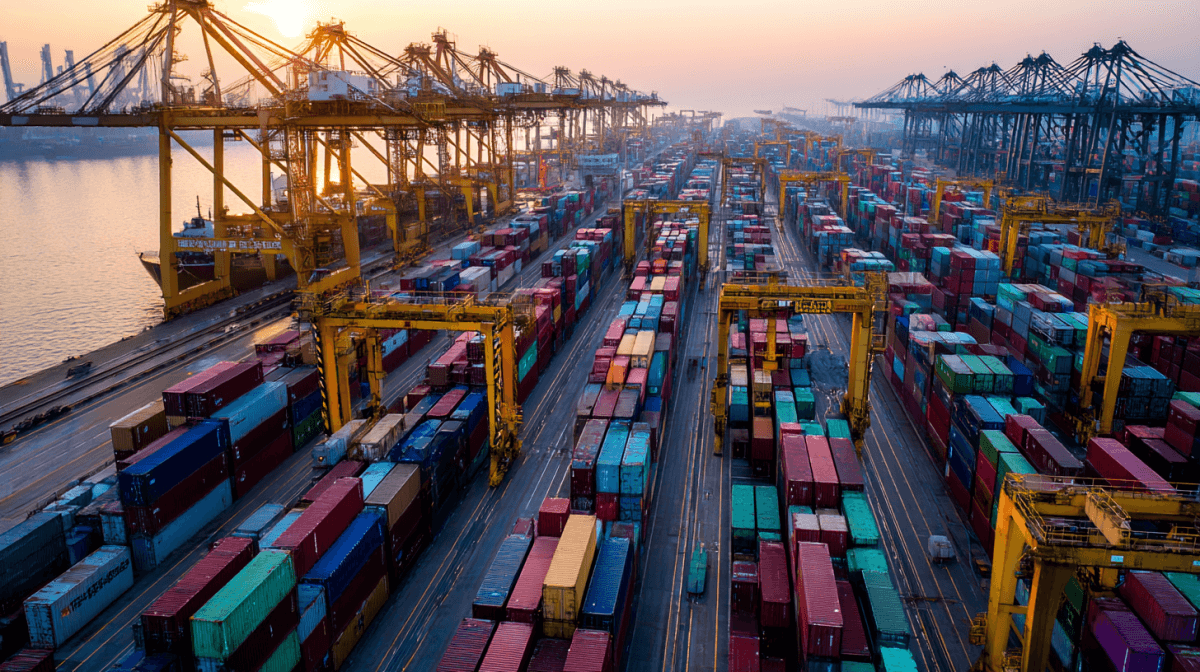

The negotiations occurred after weeks of escalating trade barriers that had effectively paralyzed nearly $600 billion in two-way trade. The tariff war had roiled global financial markets, disrupted supply chains, and stoked fears of a worldwide recession. Major shipping companies reported dramatic drops in trans-Pacific cargo volume, with logistics group Flexport noting that Pacific Ocean carriers were withdrawing capacity "at faster rates than COVID."

Markets responded enthusiastically to Monday's announcement. Wall Street futures soared, with the Dow jumping more than 1,000 points ahead of trading, while the S&P 500 and Nasdaq Composite surged 3.2% and 4% respectively. Shipping company Maersk, which had warned of declining US-China container volumes, saw its shares jump more than 12% in European trading.

The agreement establishes a mechanism for continued discussions about economic and trade relations. These talks will be led by Chinese Vice Premier He Lifeng, US Treasury Secretary Scott Bessent, and US Trade Representative Jamieson Greer. According to the joint statement, "These discussions may be conducted alternately in China and the United States, or a third country upon agreement of the Parties."

While the deal offers welcome relief to businesses caught in the crossfire, experts caution that the 90-day timeframe provides limited opportunity to address fundamental issues. "The 90-day period may not be sufficient for the two sides to reach a detailed agreement, but it keeps the pressure on the negotiation process," noted one analyst.

Some analysts view the agreement as a pause rather than a permanent solution. "It's a more civilized way to divorce. The bifurcation will continue," said Alicia Garcia-Herrero, chief economist for Asia Pacific at investment bank Natixis. "This meeting is basically an attempt, hopefully successful, of avoiding a global recession."

The temporary nature of the agreement underscores the complex challenges that remain. Secretary Bessent acknowledged in a later interview that difficult negotiations are still to come. "I don't think anything's going to be easy, because this has been going on a long time," he stated.

For businesses navigating global supply chains, the uncertainty continues despite the immediate relief. Andrew Gossage, CEO of Ultimate Products, noted that Chinese manufacturers may remain cautious about the US market even with lower tariffs. "The US has definitely gone into unreliable boyfriend territory when it comes to the attitude of the Chinese manufacturers to that market," he said.

The breakthrough comes after weeks of conflicting signals from both countries. As recently as April 24, China had denied any ongoing trade talks with the US, while President Trump contradicted those claims by asserting that meetings were indeed taking place. The dramatic shift in position reflects the economic pressures facing both nations as the high tariffs began to bite.

Sources: Reuters, CNN, CNBC, Fox Business, NPR, Washington Post, CBS News, Axios, Bloomberg