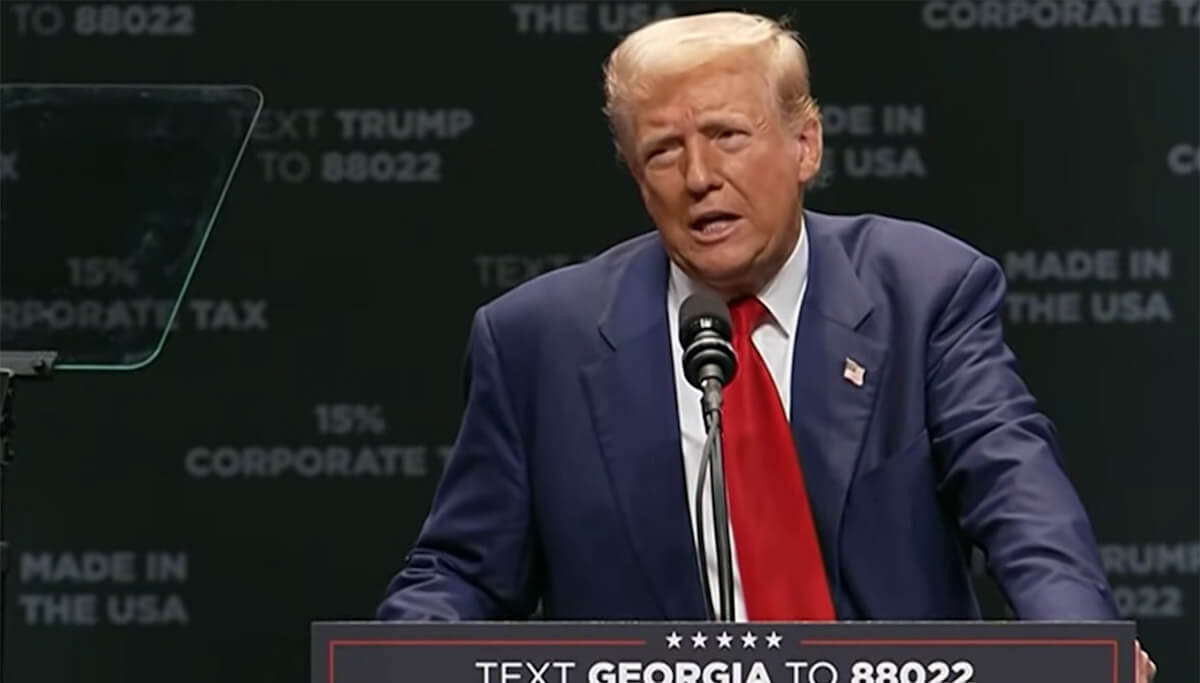

In a sweeping proposal that could fundamentally transform the United States' taxation system, President Donald Trump has floated the possibility of using tariff revenue to fund the federal government and potentially eliminate the federal income tax for American citizens. This remarkable concept emerged during a recent interview with Fox News' Rachel Campos-Duffy, representing what would be the most significant overhaul of federal taxation in over a century.

Returning to America's Revenue Roots

The President highlighted the historical precedent for this approach, noting that prior to the 16th Amendment in 1913, tariffs served as the chief source of federal income. "That was when our nation was the richest," Trump remarked, referencing the period from 1870 to 1913 when the U.S. operated without a federal income tax and relied primarily on import duties.

"There is a chance that the money from tariffs could be so great that it would replace [the income tax]," Trump told Campos-Duffy during their conversation. This statement aligns with his administration's broader trade strategy that began on April 2, a day Trump has labeled "Liberation Day," when his administration implemented tariffs on a global scale.

The Current Tariff Landscape

The tariff-centric approach is already in motion. Trump's administration has maintained high tariffs on Chinese imports, with duties reaching up to 150% on certain products. These steep rates are part of what Trump describes as a deliberate strategy to force trading partners to negotiate more favorable terms with the United States.

This aggressive stance appears to be yielding diplomatic results, with the President claiming that over 70 countries have approached the U.S. seeking to renegotiate trade terms following the recent tariff hikes. The administration is considering certain exemptions to these blanket tariffs, particularly for consumer electronics and components tied to critical technological sectors like artificial intelligence and supercomputing.

China has not remained passive in this economic confrontation. Beijing has responded with counter-tariffs on American goods and implemented export restrictions on rare earth minerals, materials vital for manufacturing high-tech products in the United States. This ongoing economic chess match illustrates the complex global implications of Trump's tariff strategy.

The Revenue Question

The proposal raises important questions about the feasibility of replacing income tax revenue with tariff proceeds. Current data from the Tax Foundation showed that in 2021, the average federal income tax rate was 14.9 percent. The distribution of this tax burden is notably uneven - the top 1 percent of earners contributed nearly 46 percent of all income tax revenue, while the top 50 percent accounted for almost the entire pool of federal income tax dollars.

Trump advisor Peter Navarro has suggested that tariffs could generate more than $6 trillion over the next decade, potentially exceeding the $4.5 trillion cost of extending the 2017 Tax Cuts and Jobs Act, which is set to expire at the end of 2025. However, some economic policy experts have expressed skepticism about these projections.

Alex Durante, senior economist at the Tax Foundation, has called the proposal "not realistic," pointing out that U.S. government spending has increased dramatically since the 19th century when tariffs were the primary revenue source. In 2023, federal government spending represented 22.7% of GDP, approximately ten times the share of the economy compared to when tariffs were the main revenue generator.

Consumer Impact and Economic Perspectives

Economic analysts have pointed out that tariffs function essentially as consumption taxes, with the costs typically passed on to American consumers through higher prices for imported goods. This aspect of the tariff strategy raises questions about how the tax burden would be distributed across different income brackets if tariffs were to replace income taxes.

While income taxes are progressive, with higher earners paying larger percentages, tariffs impact all consumers who purchase imported goods regardless of income level. This fundamental difference in tax structure would represent a significant shift in America's approach to taxation and revenue collection.

Beyond Tariffs: Additional Revenue Ideas

Campos-Duffy noted Trump's enthusiasm for this revenue model during their interview, saying, "He's seeing this as another form of revenue. In fact, he talked about just how much revenue was coming into the country... This is something I think he's really committed to doing."

The tariff proposal isn't the only innovative revenue idea Trump has explored. He has previously entertained the concept of issuing "DOGE Dividends" - checks to taxpayers derived from savings accrued through spending cuts by the U.S. Department of Government Efficiency. This approach would reward citizens for reporting government inefficiencies and potentially return significant sums to American taxpayers.

Looking Ahead

While the concept of replacing income tax with tariff revenue represents a dramatic departure from modern American fiscal policy, it reflects Trump's broader vision of reshaping global trade relationships to prioritize American economic interests. The practical implementation of such a fundamental change would require significant legislative action and economic adjustments.

The proposal has sparked debate among economic experts, policymakers, and the public about the feasibility and implications of such a dramatic shift in taxation strategy. Whether this bold vision becomes reality or remains a thought experiment, it underscores the administration's commitment to rethinking traditional approaches to both international trade and domestic revenue collection.

As the global economic landscape continues to evolve and trade relationships adjust to new pressures and incentives, Americans will be watching closely to see how these proposals develop and what they might mean for both their tax bills and the prices they pay for everyday goods.